Buying a house is one of the biggest financial decisions most people will make in their lives. In Malaysia, understanding the costs involved in purchasing a property is crucial. One of these costs is stamp duty, which plays a significant role in the property transaction process. This article will explain what stamp duty is, why it is important, and how it affects home buyers in Malaysia.

What is Stamp Duty?

Stamp duty is a tax that is imposed on certain documents related to property transactions. In Malaysia, it is mainly applied to the Sale and Purchase Agreement (SPA) when buying a property. The amount of stamp duty you need to pay depends on the purchase price of the property. The rates are tiered, meaning that different portions of the property price are taxed at different rates.

For example, as of 2024, the stamp duty rates for residential properties are as follows:

- 1% on the first RM100,000

- 2% on the next RM400,000 (from RM100,001 to RM500,000)

- 3% on the next RM500,000 (from RM500,001 to RM1,000,000)

- 4% on any amount above RM1,000,000

These rates make it clear that the more expensive the property, the higher the amount of stamp duty you will have to pay.

Why is Stamp Duty Important?

1. Legal Requirement

One of the main reasons stamp duty is important is that it is a legal requirement in Malaysia. The government imposes this tax to ensure that property transactions are officially recorded. Without paying stamp duty, the Sale and Purchase Agreement is not considered valid. This means that you could face legal issues if you try to enforce the agreement without having paid the required stamp duty.

2. Proof of Ownership

Stamp duty serves as proof of ownership. Once you pay the stamp duty and the agreement is stamped, it becomes a legal document that shows you are the rightful owner of the property. This is essential for any future transactions, such as selling the property or applying for loans against it.

3. Impact on Overall Costs

When buying a house, it’s essential to consider all costs involved, and stamp duty is a significant part of that. Knowing how much you will need to pay in stamp duty helps you budget better for your home purchase. This can impact your decision on how much you can afford to spend on a property.

4. Affects Financing Options

Many banks and financial institutions consider the total costs of buying a home when approving loans. If you are not aware of the stamp duty and its impact on your budget, it could affect your ability to secure financing. Lenders want to ensure that you can cover all costs, including stamp duty, before approving your mortgage.

5. Encourages Serious Buyers

Stamp duty can also serve as a filter for serious buyers. Knowing that there are additional costs involved in buying a property may discourage casual buyers from pursuing a purchase. This means that when you engage with the market, you are more likely to interact with other serious buyers and sellers, making the process smoother.

6. Government Revenue

From a broader perspective, stamp duty is an important source of revenue for the Malaysian government. This revenue is used to fund public services and infrastructure projects. Understanding the importance of this tax can help buyers appreciate their role in contributing to the economy.

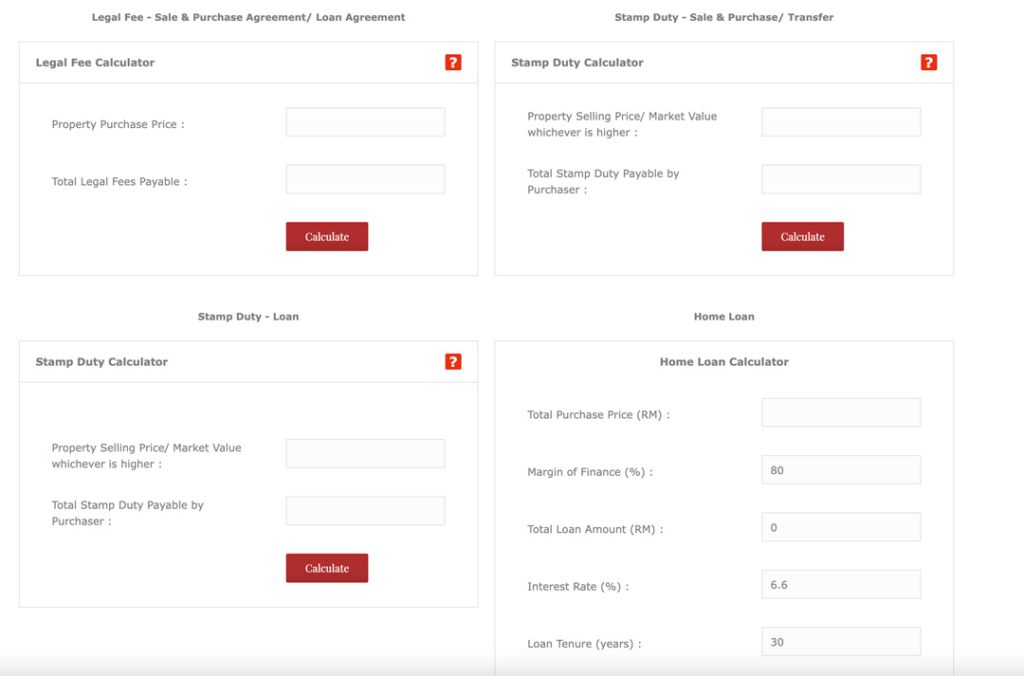

How to Calculate Stamp Duty

Calculating stamp duty is straightforward once you know the purchase price of the property. Here’s a simple way to calculate it:

- Determine the Purchase Price: Know the exact price you are paying for the property.

- Apply the Stamp Duty Rates: Use the tiered rates to calculate the stamp duty based on the purchase price.

For example, if you are buying a house for RM600,000, the calculation would be:

- 1% on the first RM100,000 = RM1,000

- 2% on the next RM400,000 = RM8,000

- 3% on the remaining RM100,000 = RM3,000

Total Stamp Duty = RM1,000 + RM8,000 + RM3,000 = RM12,000

Exemptions and Reliefs

In Malaysia, there are certain exemptions and reliefs available for stamp duty, especially for first-time home buyers. The government often provides incentives to encourage home ownership. For instance, first-time buyers may be exempt from paying stamp duty on properties below a certain price.

It is essential to check the latest regulations and exemptions on the official website of the Inland Revenue Board of Malaysia or consult with a real estate agent for the most current information.

Final Thoughts

Stamp duty is a critical aspect of buying a house in Malaysia. It is not just a tax; it is a legal requirement that proves ownership and impacts your overall budget. Understanding stamp duty helps you prepare for the costs associated with purchasing a property and ensures that you comply with legal obligations.

As a buyer, being informed about stamp duty and its implications can lead to a smoother home-buying experience. Always consider this cost in your budget and stay updated on any exemptions or reliefs that may apply to you. By doing so, you can make better decisions and enjoy the journey of finding your perfect home.